The Insurance Stack is Compressing

A conversation with Joe Zuk on how risk capital is moving closer to origination

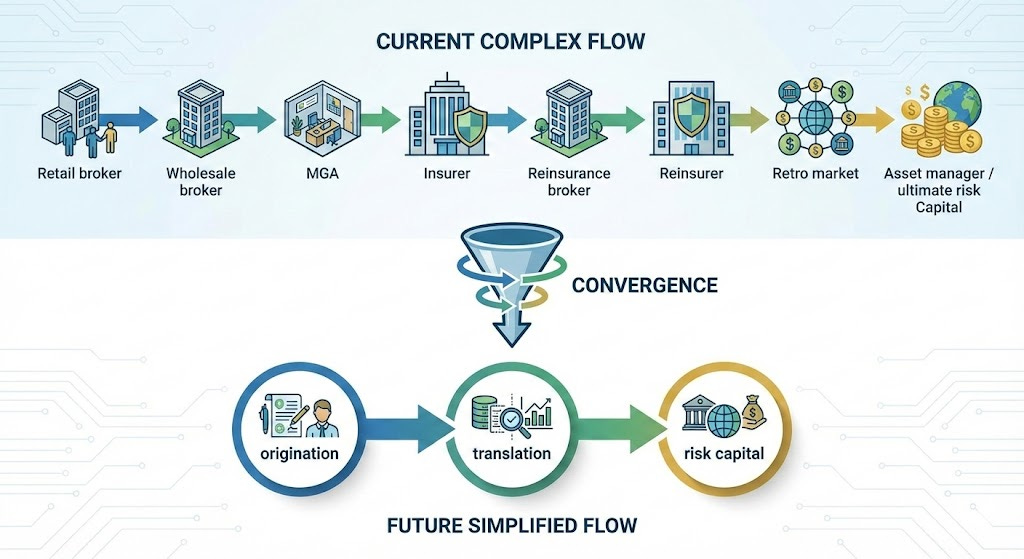

Historically, insurance has been somewhat of a relay race. Retail brokers hand off to wholesale brokers, to MGAs, to carriers, to reinsurers, to retro markets, and eventually to asset managers, who are the ultimate destination for risk capital. Each handoff adds time and cost.

But over the last 6-9 months, that has started to shift. Capital pressure is driving a broader search for yield. Insurance, with its structured risk and returns, looks increasingly attractive to asset managers. At the same time, thanks to technology, we have better tooling and data infrastructure to describe, price, and monitor risk with much more granularity than before.

I recently spoke with Joe Zuk, an insurance veteran and operating partner at Altamont Capital, to discuss why this is changing and what it means for the insurance industry as a whole.

Re-architecting Origination

“AI is changing the way risk is originated and matched with capital providers, not just at the point of sale,” he told me, “but by automating data entry, and ingesting structured and unstructured data into a risk profile — and then monitoring how that risk profile evolves over time.”

This means you can now continuously track how exposure changes and how capital should be allocated.

Much of the current insurance AI landscape is focused on these ingestion engines, which are commoditizing quickly. “It’s hard to get excited about ten companies doing the same narrow thing, especially when frontier labs are increasingly providing the primitives to build it yourself,” Joe told me. Adding that “what’s notable is how little of this exists end-to-end today. Most systems still solve single slices: document ingestion, underwriting workbenches, policy admin, and billing. There’s not a platform yet.”

Of course, it’s still early, and most companies are starting with narrow wedges – as they should. But the opportunity here is to build coherence across the stack.

In an ideal state, Joe imagines a natural-language interface where a broker or customer can describe exposures, and the system assembles the appropriate product, which isn’t just a quote, but a structured risk profile connected to capital.

This pairs with a deeper shift in how policies themselves are constructed.

“Policy language is very similar to the publishing business – you’re dealing with blocks of consistent verbiage,” Joe told me. “The challenge is how you arrange those blocks and ensure consistency.” Rather than monolithic policies, this enables modular coverage. Instead of bespoke wordings every time, coverage becomes plug-and-play, assembled from standardized components that fit together cleanly.

This not only makes the end-to-end process faster, but it also changes how risk and coverage are understood, compared, and priced.

From eight layers to three, and eventually just two

Joe believes that the insurance stack will compress. What was once an eight-layer chain begins to look more like three:

Origination: retail and wholesale brokers, increasingly software-driven

Translation: normalization, modularization, and matching logic

Risk capital: increasingly commoditized, competing on cost and time horizon

Over time, capital becomes less differentiated, and value accrues to origination and translation, which may eventually merge.

But Joe doesn’t think wholesalers and MGAs will go away. AI can compress workflows, but it doesn’t compress trust. “In insurance, relationships still matter a lot.” Instead, what changes is scale. Fewer people and fewer handoffs, “There’s still going to be a sales and concierge aspect of this that folks will be highly reliant on. But I think it probably does shrink over time.”

The Upside, and the Risks

There’s a reordering of the insurance value chain underway.

“What excites me most is how much value there is to unlock by closing the coverage gap. Selling more insurance and democratizing access to risk transfer through transparency,” Joe told me toward the end of our conversation.

Adding that, “What worries me is the flip side: the concentration of power in platform operators that control access to data, fragmented regulation, and the risk of becoming overly reliant on systems we don’t fully understand.”

As risk capital moves closer to origination, the layers that once existed to translate, delay, and buffer risk are beginning to collapse.

Author’s note: An LLM was used for light copy editing only (spelling, grammar, and clarity). Content, meaning, tone, and structure remain unchanged.